So, if the company somehow classifies these items within Working Capital, remove and re-classify them; they should never affect Cash Flow from Operations. The short answer is that you should follow what the company does, and you shouldn’t worry about placement as long as the item correctly factors into Cash Flow from Operations (and metrics like Free Cash Flow and Unlevered Free Cash Flow). The Change in Working Capital tells you if the company’s Cash Flow is likely to be greater than or less than the company’s Net Income, and how much of a difference there will be. In 3-statement models and other financial models, you often project the Change in Working Capital based on a percentage of Revenue or the Change in Revenue. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer.

How Do You Calculate Working Capital?

Using hedging strategies to offset swings in cash flow can mitigate unexpected changes in working capital. However, there are some costs involved in these hedging transactions, which could affect cash flow. Changes in net working capital refers to how a company’s net working capital fluctuates year-over- year.

- You then take last year’s working capital number and subtract it from this year’s working capital to get change in working capital.

- Since the company is holding off on issuing payments, the increase in payables and accrued expenses tends to be perceived positively.

- Generally, a working capital ratio of less than 1.0 is an indicator of liquidity problems, while a ratio higher than 2.0 indicates good liquidity.

- This calculation helps assess a company’s short-term liquidity and operational efficiency.

Download a free copy of “Preparing Your AP Department For The Future”, to learn:

This is a good sign for the company because it is trying to keep its money accessible and ready for use. This includes bills and obligations you still need to pay, such as what you owe to your suppliers, lenders, or service providers. Continuing with the example, if you owe $678,000, you https://www.bookstime.com/accrual-basis will subtract this amount from your $2.158 million, leaving you with $1.48 million. It might indicate that the business has too much inventory or isn’t investing excess cash. Alternatively, it could mean a company fails to leverage the benefits of low-interest or no-interest loans.

Everything You Need To Build Your Accounting Skills

The working capital ratio is a method of analyzing the financial state of a company by measuring its current assets as a proportion of its current liabilities rather than as an integer. Given a positive working capital balance, the underlying company is implied to have enough current assets to offset the burden of meeting short-term liabilities coming due within twelve months. The working capital metric is relied upon by practitioners to serve as a critical indicator of liquidity risk and operational efficiency of a particular business. Understanding how changes in working capital can affect cash flows is important for a good financial model. Calculating working capital requires building a model in Excel and using data from a company’s income statement (IS) and balance sheet (BS). It can be influenced by how the company conducts business with its suppliers, vendors, and customers.

Meanwhile, the company experiences rapid growth in production, requiring increased inventory levels and faster payments to suppliers, causing a surge in A/P. In this scenario, the company’s net working capital decreases, signaling potential cash flow constraints and liquidity challenges. A company’s balance sheet contains all working capital components, though it may not need all the elements discussed below. For example, a service company that doesn’t carry inventory will simply not factor inventory into its working capital calculation. To calculate working capital, subtract a company’s current liabilities from its current assets.

Everything to Run Your Business

If your net working capital one year was $50,000 and the next year it was $75,000, you would have a positive net working capital change of $25,000. We’ll now move on to a modeling exercise, which you can access by filling out the form below. Like so many other business processes, managing net working capital is much easier with help from digital transformation change net working capital formula tools such as artificial intelligence, advanced data analytics, and robotic process automation. This compares favorably to last year, when its NWC balance was $140,000 ($970,000 – $830,000). The Change in WC has a mixed/neutral effect on Best Buy, reducing its Cash Flow in some years and increasing it in others, while it always increases Zendesk’s Cash Flow.

Net Working Capital Calculation Example (NWC)

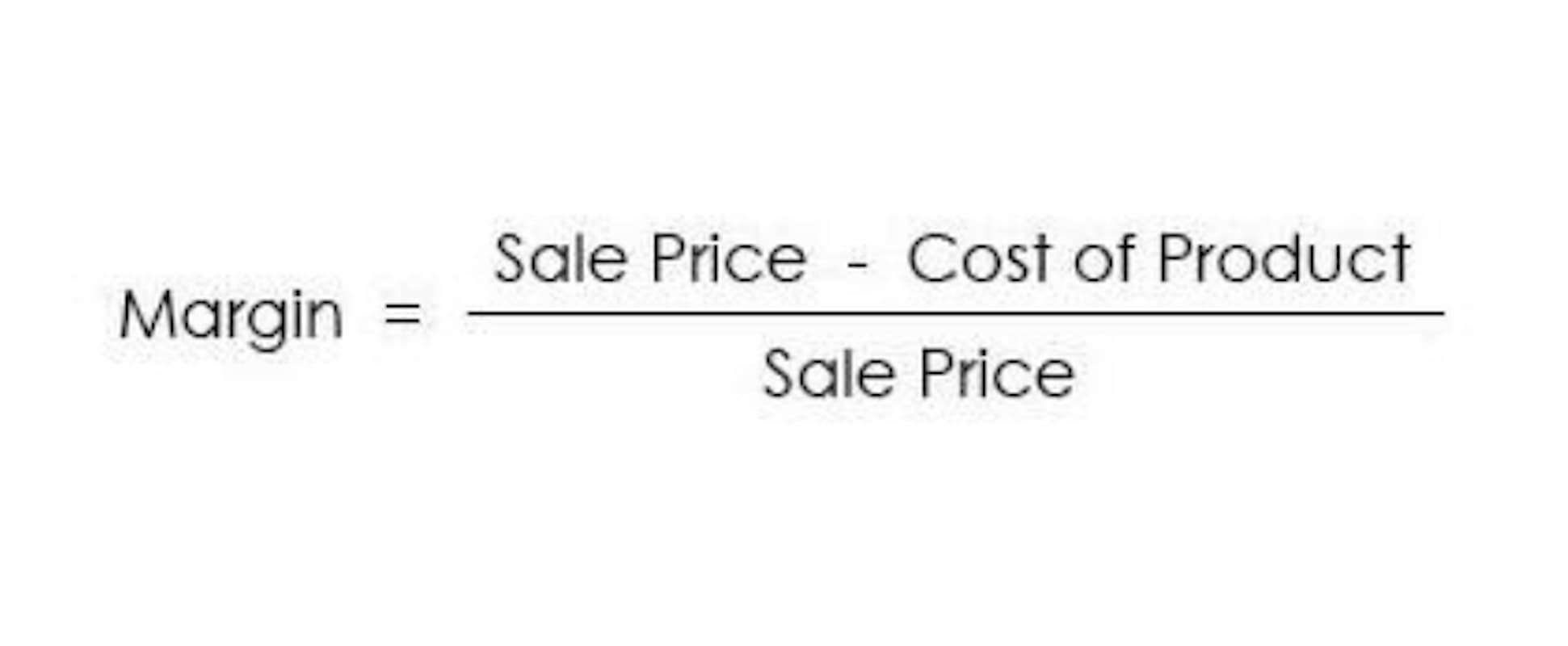

The rationale for subtracting the current period NWC from the prior period NWC, instead of the other way around, is to understand the impact on free cash flow (FCF) in the given period. The NWC metric is often calculated to determine the effect that a company’s operations had on its free cash flow (FCF). If the change in working capital is negative, it means that the change in the current operating assets has increased more than the current operating liabilities. Another way to measure working capital is to look at the working capital ratio, which is current assets divided by current liabilities.

- If your net working capital one year was $50,000 and the next year it was $75,000, you would have a positive net working capital change of $25,000.

- Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

- The level of working capital of a company indicates how liquid your business is and determines your ability to convert your assets into cash to pay your debt.

- Understanding changes in cash flow is also important if you are applying for a small business loan.

- Change in working capital, on the other hand, measures what is happening over a given period of time with regard to the liquidity of your company.

- If your firm experiences a positive change in net working capital, it may have more cash to invest in growth opportunities or repay debt.

Changes in working capital can occur when either current assets or current liabilities increase or decrease in value. A company that has negative net working capital may have short term liquidity problems, including insolvency. For most companies, net working capital is calculated from five accounts on the balance sheet. On the assets side, the company’s cash, marketable securities, accounts receivable, and inventory are considered. On the liabilities side, the company’s accounts payable is the only account needed.